Join us for a look at the dynamic landscape of Professional Employer Organizations (PEOs) and the transformative trends and key transactions that shaped the industry in 2023. The PEO sector is experiencing a seismic shift, driven by mergers, acquisitions, and a surge in private equity investments, offering unparalleled opportunities for innovation and specialization.

Decoding the PEO Advantage

PEOs redefine the space by offering small and mid-sized businesses a comprehensive suite of services, including HR, compliance, payroll, and benefits administration through a unique co-employment arrangement. This strategic partnership sees worksite staff co-employed by the client organization and the PEO entity, with the PEO taking charge of critical functions like payroll, benefits, HR services, and regulatory compliance.

The result? Businesses can focus on growth, tapping into enterprise-grade HR tools, and enjoy cost efficiencies from benefits pooling, with potential savings of 10-15% over alternative options.

The PEO model is not a one-size-fits-all solution; in fact, many PEOs specialize in specific industries, company sizes, or geographic regions, ensuring tailored and optimized services for their clients.

Forces Shaping the PEO Landscape

In 2023, the PEO industry was influenced by several interconnected forces:

Consolidation and Roll-Ups

We’ve witnessed accelerated consolidation as PEOs compete for large clients and private equity investments soar. Mergers and acquisitions are on the rise, reshaping the market and concentrating resources.

Specialization

PEOs are leveraging mergers, acquisitions, and capital infusion to carve out specialized niches, focusing on high-growth sectors such as tech, healthcare, and financial services. This not only captures market share but also drives innovation in compliance, HR services, and more.

Innovation

Welcome the integration of next-gen platforms into the PEO landscape, featuring AI, advanced analytics, mobile capabilities, and robotic process automation. Tech-enabled differentiation is the name of the game, with some PEOs exploring white-labeled offerings and services like independent contractor support.

Geographic Expansion

The leading PEOs are on a mission to establish national footprints, supporting clients with dispersed operations and enabling risk pooling across state lines. This expansion puts them in a league of their own, leaving regional counterparts scrambling to match their capacity and resources.

New Entrants

Keep an eye on new entrants like large banks and insurance carriers, making bold moves in the PEO space with aggressive M&A strategies. Their robust infrastructure, capital bases, and distribution channels pose a threat to established players.

Key Transactions Shaping 2023

Several noteworthy transactions highlight the impact of the transformative forces we tracked in 2023:

OneDigital – Resourcing Edge

OneDigital’s strategic acquisition of Resourcing Edge marks its entry into the PEO space, expanding its HR capabilities and unlocking cross-sell opportunities in the extensive small business customer base at OneDigital.

Paychex – Mid-Sized PEO

Paychex’s savvy acquisition of a mid-sized PEO enables it to diversify its service suite, tapping into specialized professional employer services and meeting the demands of a loyal client base.

CoAdvantage – Tech PEO

The merger between CoAdvantage and a tech-focused PEO injects next-gen platforms into the former’s infrastructure. This move not only bolsters technological prowess but also enhances competitive advantage.

Morgan Stanley – PEO Buyout

The acquisition of a privately held PEO operator by Morgan Stanley Capital Partners in a traditional buyout structure signals the growing interest of private equity in funding consolidation plays and capturing sector growth.

These transactions underscore a collective willingness to consolidate, integrate, and innovate, riding the wave of an estimated >10% Compound Annual Growth Rate (CAGR) for the PEO industry, supporting a vast workforce of over 15 million.

Strategic Motivations Shaping the Future

Drawing insights from these transactions, four primary strategic motivations are steering the ongoing evolution of the PEO landscape:

Rapid Growth Ambitions

Top PEOs are strategically consolidating regional players, amassing large national client bases, and achieving density for effective risk pooling.

Vertical Integration

The pursuit of one-stop HR and benefits shops is driving insurers and banks to seek PEO capabilities, reshaping the competitive landscape.

Specialized Expertise

The desire for niche industry, compliance, and tech skills is at the heart of strategic deals, enabling PEOs to offer differentiated and highly specialized services.

Innovation Bets

Investments in next-gen platforms or business models, such as independent contractor support, are defining the competitive edge for PEOs.

These strategic moves also bring additional benefits, including talent acquisition, customer base diversification, improved risk management through multi-state pooling, expanded revenue streams, and potential cost savings through leveraging centralized functions.

Key Players at the Helm of Market Evolution

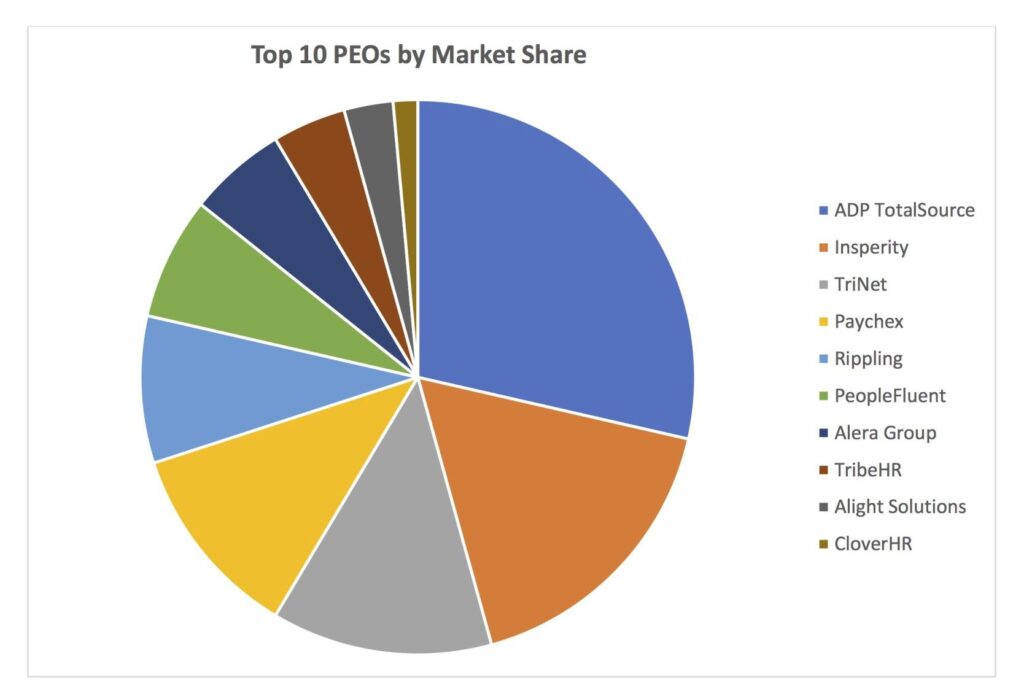

In a field of more than 900 registered firms, a select group is leading the way:

Industry Stalwarts

ADP TotalSource, Insperity, Paychex, and TriNet dominate with extensive client bases, leveraging their long operating histories and abundant resources to accelerate niche capabilities.

Scaling Powerhouses

Fast-expanding PEOs like Oasis, Elements, Total HR, and isolved People Cloud are centralizing operations to absorb books of business profitably.

Niche Specialists

Concentrated PEOs focusing on specific sectors, regions, compliance demands, and tech deliver highly tailored services exceeding 800+ worksite employees.

De Novo Entrants

New companies like Justworks, Gusto, and Rippling highlight emerging business models centered around simplified software platforms, contractor workforces, and remote teams.

Riding Favorable Tailwinds

As we venture into the future, several favorable tailwinds continue to propel the PEO sector forward:

Post-pandemic Labor Complexity

The tighter talent market and increased compliance risks post-pandemic are driving businesses toward PEO solutions.

Digital Workforce Transformation

The need for infrastructure to support remote teams and contractors has made PEOs very appealing to the business community.

SMB Access to Enterprise Solutions

Small and mid-sized businesses require advanced tech and data solutions, which PEOs can provide.

Innovative Service Models

Customization for unique business demands is a key driver of PEO adoption.

Expanding Adoption of Co-Employment

Recognition of the strengths of the co-employment model is increasing.

Private Capital Investments

Substantial private capital investments are fueling M&A activity and platform innovation.

As top PEOs strategically position themselves for sector expansion through M&A activities, capital allocation, and responsive solutions, the industry’s future looks promising.

The Uncharted Path Ahead

Fueled by private equity interest and a growing acceptance of co-employment arrangements, the metamorphosis of the PEO industry is in full swing as top providers engage in aggressive acquisition campaigns and innovative product offerings.

Looking forward, expect a continued trend toward dominant national PEOs that provide specialized services at scale. Even so, there’s room for disruptive players to thrive by targeting emerging niches, such as technology infrastructure, services supporting agile remote teams, and unconventional business models.

As the complexity of people management heightens and over 14 million small and mid-sized businesses seek support, PEOs are on an unwavering growth trajectory. The competitive landscape in five years remains fluid, with specialization and client-adaptive innovation steering the course of the industry. Despite everywhere that 2023 has taken PEOs, the journey is just beginning.