As a growing electrical subcontractor with 60 employees, you’re reaching an inflection point. You’ve built a successful business, but administrative tasks like payroll, benefits, and HR compliance are becoming more complex and time-consuming. This is draining your focus and resources from core electrical services and new business development. Is a PEO the solution?

A Professional Employer Organization (PEO) can provide welcome relief. By outsourcing key HR functions to a PEO, you can reduce costs, access Fortune 500-level benefits, and alleviate administrative burdens. However, not all PEOs are created equal. It takes due diligence to choose the right partner for your organization.

This proposal provides a roadmap for evaluating PEOs. It covers:

- Key benefits of a PEO partnership

- Procedures for selecting a PEO

- Must-have services to require from a PEO

- Cost-saving opportunities

- Compliance considerations

- Pitfalls to avoid

With the right PEO, you’ll gain back time and energy to focus on your core business, and your employees will enjoy improved benefits offerings. Let’s take a look at how to make this transition successfully.

Key Benefits of a PEO Partnership

Outsourcing HR administrative functions to a PEO offers electrical subcontractors like yours the following advantages:

Reduced HR workload. A PEO handles payroll, benefits, compliance, and other intensive back-office tasks. This takes some weight off your current HR staff and lets them focus on more strategic initiatives.

Access to Fortune 500 benefits. By co-employing your staff, a PEO gives access to large group rates on health insurance, retirement plans, life insurance, and other perks typically reserved for major corporations. This improves talent attraction and retention.

Cost savings. PEOs use economies of scale to reduce expenses related to payroll administration, healthcare, workers’ compensation, regulatory compliance, and more. These savings get passed onto your organization.

Risk mitigation. With a PEO as co-employer, you share liability for HR-related litigation. The PEO’s expertise also helps avoid fines and penalties from noncompliance. This reduces legal exposure.

Expert HR guidance. PEOs stay current on constantly changing state and federal regulations. Their guidance helps you avoid missteps on labor law compliance, safety requirements, leave administration, and more.

With these advantages, it’s clear why PEO adoption has grown 7% annually in recent years. Over 90% of PEO clients renew each year. For mid-size, high-growth companies like yours, the benefits are too significant to ignore.

Choosing the Right PEO: 5-Step Process

Not all PEOs are created equal. It’s important that you do your homework to choose the right partner for your organization. Follow these steps:

- Define goals and must-have services. Document what you hope to achieve via PEO adoption and the specific services you require. We’ll explore these in the next section. This will drive who you consider and help compare options.

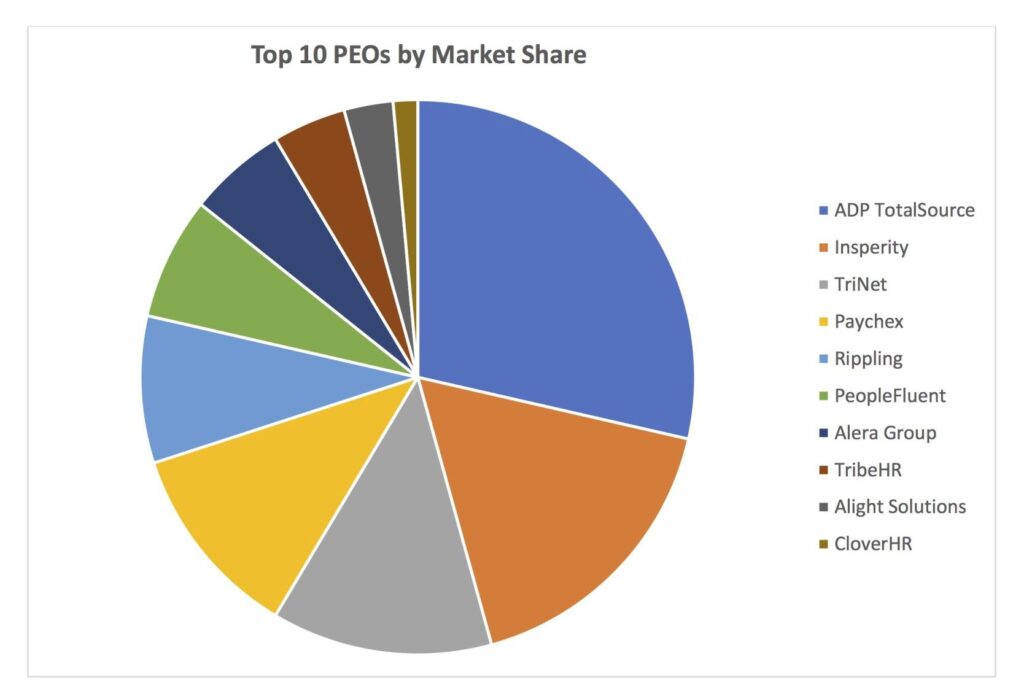

- Research options and create a short list. Search online directories and local contacts to compile a list of potential PEOs. Narrow to around 3-5 firms that seem to fit your criteria. Larger PEOs can offer greater economies of scale while smaller, local ones may provide more customized service. Include a mix in your consideration set.

- Issue RFPs. For each PEO candidate, issue a detailed Request for Proposal (RFP) soliciting information on services, capabilities, pricing, and implementation plans. Provide the same requirements to each for an apples-to-apples comparison.

- Interview finalists. Based on RFP responses, select 2-3 finalists to bring in for more in-depth interviews. These direct meetings will allow you to assess company culture fit and follow up on outstanding questions.

- Run background checks. For your top choice, obtain references from current clients, review Better Business Bureau records for complaints, and run credit checks to assess financial stability.

Undertaking this diligent 5-step approach will help identify the ideal PEO to meet your needs and provide maximum value to your organization.

Must-Have Services to Require from a PEO

The services you require from a PEO will depend on your specific pain points and growth goals. However, most electrical subcontractors in your situation should minimally require the following from a potential provider:

Payroll processing. The PEO should handle all payroll tasks, including calculating pay, cutting checks, direct deposit, and preparing quarterly tax paperwork.

Benefits administration. Require the PEO to offer access to group medical, dental, vision, life insurance, 401k plans, and other benefit packages exceeding what you could secure independently.

Compliance expertise. Leverage the PEO’s knowledge of HR regulations across multiple states. Require guidance on labor laws, safety requirements, leaves, handbooks, and staying compliant as laws change.

Technology platform. Ensure the PEO offers online HR platforms for you to view payroll details, access employee records, manage time-off requests, and streamline other administrative HR tasks.

Workers’ compensation. Stipulate that the PEO provides this mandatory insurance coverage and assists with claim administration.

Training. The PEO should periodically conduct on-site training for your managers on best practices related to hiring, retention, proper documentation, safety, preventing lawsuits, and other key topics to avoid problems down the line.

Any PEO unable to comprehensively provide these baseline services is likely not ready to scale with your growing business. Make these table stakes in your RFP process.

Cost Savings Opportunities to Explore

A major benefit of PEO adoption is access to significantly lower costs for payroll administration, insurance, compliance, and other HR-related functions. During your RFP and evaluation process, target the following areas of potential cost savings:

Payroll processing fees. PEOs can handle payroll at a fraction of the cost of doing it in-house given their economies of scale. Ask candidates to detail expected per employee per month (PEPM) fees for payroll versus your current internal costs.

Healthcare premiums. PEOs with thousands of employees can secure major group discounts exceeding 30%. Have candidates show how medical, dental, and vision premiums would compare against your current plan pricing.

Retirement plan fees. Similarly, 401k and other retirement plans can be offered at lower expense ratios given the pooled assets. Request fee comparisons.

Overtime costs. Some PEOs offer HR consultants that can periodically review schedules and staffing to right-size jobs and avoid unnecessary overtime. Explore if candidates provide this.

Workers’ comp premiums. A PEO’s focus on safety and return-to-work programs can significantly reduce this expense. Ask for estimated rates versus your current.

Compliance fines. Document if the PEO will share liability for any compliance failures that result in fines during your partnership to motivate avoidance.

RFP respondents that cannot demonstrate meaningful cost savings lack scale advantages and may not be ready for your account. Use provided price benchmarks to negotiate the lowest viable rates. Cost savings should more than offset PEO fees.

Multi-State Payroll Considerations

With electrical project work spanning multiple states, handling payroll compliantly across boundaries is complex. Confirm prospective PEOs have infrastructure to smoothly handle regional payroll needs, including:

- Experience with reciprocal state arrangements

- Ability to manage different state tax rates

- Knowledge of varying rules on overtime calculations

- Capability to process multiple local tax jurisdictions

- Understanding of applicable rules if employees live and work in different states

Don’t assume all PEOs can seamlessly handle multi-state payroll. Given your footprint, probe this specifically during the interview process and reference check calls. Improper payroll could invalidate your PEO partnership and cause major tax headaches.

Avoiding Common PEO Pitfalls

While PEOs generate significant advantages, there are also risks to avoid:

Loss of control. Some organizations feel they lose authority over employees by co-employing with a PEO. Mitigate this by specifying decision rights over hiring, firing, promotions, pay rates, schedules, etc. remain with your leadership team in the partnership agreement.

Cost creep. PEO rates can slowly climb over time, eroding projected savings. Build in caps on annual rate increases into your contract and stipulate opportunities to renegotiate for lower fees if warranted.

Lack of customization. Large PEOs inclined to take a one-size-fits-all approach may not meet your unique needs. Seek out smaller providers open to customization if necessary.

Cyclical business risk. Some PEOs lack financial stability to weather economic cycles. Review financial audits and credit checks of potential partners to ensure they have solid backing.

Bad culture fit. Since you are effectively entering into a co-employment partnership, ensure your values, communication styles, and operating norms align. Carefully vet soft factors during interviews.

By investigating these areas up front in your selection process, you can avoid encountering major stumbling blocks down the line.

Conclusion

Adopting a PEO can access tremendous potential to alleviate HR administrative burdens, enhance your benefit offerings, reduce costs, and fuel growth for your electrical subcontracting business. However, identifying the right partner requires rigorous due diligence across multiple dimensions from services to culture to finances. Follow the game plan outlined in this proposal, and you will be well on your way to a PEO partnership that delivers maximum benefit for years to come.